Revenue and Expenditures

We have created this page to aid in understanding how your taxes are being utilized, and to show how your tax dollars support public entities and services. In this page, we break down the Property Taxes, Transient Room Taxes, Payroll Taxes, and other sources of revenue collected for the many Government entities of Grant County.

Grant County Property Taxes

Understanding Your Grant County Property Tax Bill

Pictured below is a chart that shows the percentages of a 2023 Property Tax Bill in Unincorporated Grant County, District 01. As the chart shows, for example, 9.9% of your Property Tax Bill goes to the Grant County Fiscal Court. Depending on where you own property, the percentages will change. For example, if you live in the City of Williamstown, Dry Ridge, Crittenden, or Corinth, your property tax percentages will differ. (Information was obtained from the Grant County Property Valuation Administration.) Other than for the State of Kentucky, each of these organizations pictured below are made up of local Board Members from within Grant County.

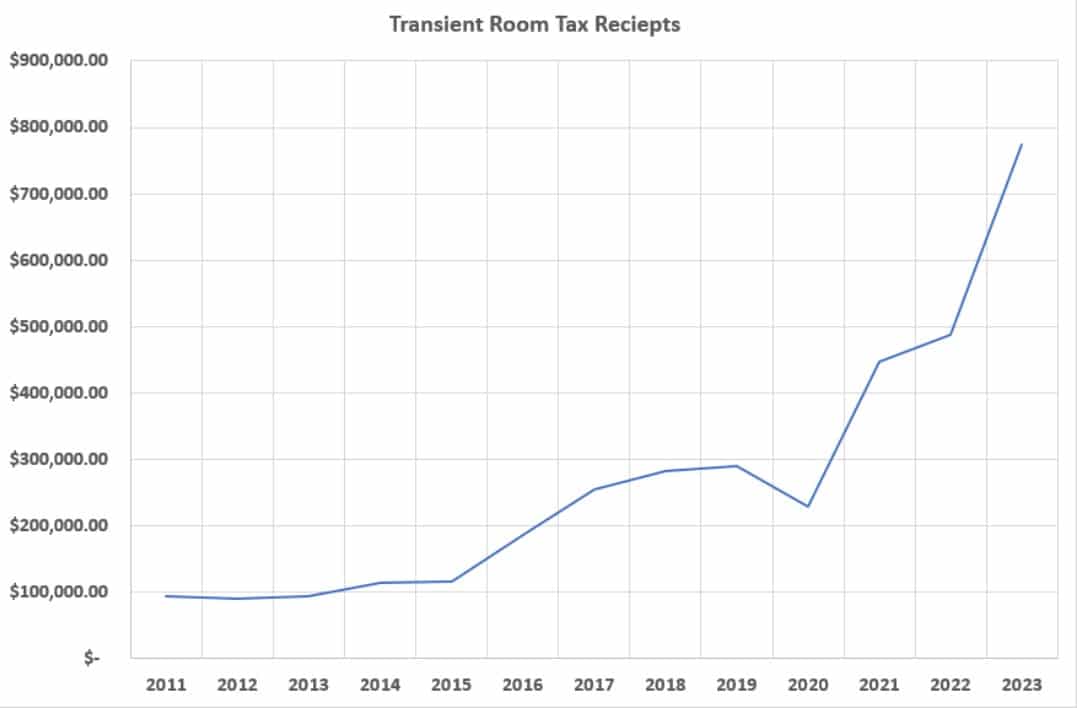

Transient Room Taxes

Since the mid-2010s, the Tourism Industry in Grant County, Kentucky has become an integral part of our community and economic landscape. Following the opening of the Ark Encounter, tourism in Grant County has exponentially increased, subsequently leading to a drastic increase in collection of Transient Room Taxes. Each Hotel, Campground, and Short Term Rental Property are required to pay Transient Room Taxes, 3% of their gross receipts, to the Grant County Tourism & Convention Commission, a public organization that acts as a partner of the community and is tasked with furthering Tourism initiatives in Grant County. These Transient Room Taxes are taxes that a local government can levy for the sole purpose of promoting tourism. These taxes are not able to be used for Grant County Fiscal Court’s General Fund.

Though these taxes can only be used for Tourism Purposes, the Grant County Fiscal Court acts as the collection agency for the Transient Room Taxes. Upon receipt, we send the collected taxes to the Grant County Tourism & Convention Commission. The Grant County Fiscal Court retains 3% of the collected taxes which can be used for the General Fund.

For reference of the increase in Transient Room Tax Receipts, we have provided the chart below (Information was obtained from the Grant County Tax Administrator):